what is base lending rate

That means the prime rate is typically about 3 higher than the federal funds rate. The State Bank of India has increased its base rate and benchmark prime lending rate on Wednesday by 70 basis points bps to 87 and 1345 respectivelyThe higher rates are effective from September 15 2022.

Malaysia Saving And Lending Rates Ceic

The Bank of England Base Rate has been consistently low for a number of years.

. The interest rate of a loan simply describes the rate at which interest will accrue on the loans balance. Oil price and gold price base January 2000 100 Figure 111. Effective 1 August 2022 SBR is the reference rate that all banks will use in the pricing of new retail floating-rate loansfinancing refinancing of existing retail floating-rate loansfinancing and the renewal of revolving retail floating-rate loansfinancing.

This percentage was determined by Bank Negara Malaysia BNM based on how much the cost would be to lend money to other financial institutions in Malaysia. A financial market is a market in which people trade financial securities and derivatives at low transaction costsSome of the securities include stocks and bonds raw materials and precious metals which are known in the financial markets as commodities. What the Fed sets is the federal funds rate the rate at which financial institutions lend money to each other.

Guide to Consumer on Reference Rate Bahasa Melayu Base Rates BLR and Indicative. Prior to 2015 the interest rate was referred to as the Base Lending Rate BLR. A prime rate or prime lending rate is an interest rate used by banks.

To cover their costs banks need to pay less on saving than they make on lending. Export prices of agricultural products base January 2000 100. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions reserve requirementsInstitutions with surplus balances in their.

The base rate will also impact on Swap rates the interest rate banks charge when lending to each other. Additionally the velocity of the monetary base is interest-rate sensitive the highest velocity being at the highest interest rates. APR takes interest into account but also adds fees that you have to pay and some other.

We maintain this page because the changes reveal important interest-rate trends that drive business lending rather than revealing specific lending cost levels. In the news its sometimes called the Bank of England base rate or even just the interest rate. The Federal Reserve on Wednesday approved its first interest rate increase in more than three years and said it expects to keep raising through the end of the year.

The Base Rate is the official interest rate set by the Bank of England. Effective January 2 2015 the Base Lending Rate BLR structure was replaced with a new Base Rate BR system. Copper and aluminium prices base January 2000 100 Figure 112.

Our Monetary Policy Committee MPC sets Bank Rate. The ISG observed that internal benchmarks such as the Base rate. The prime rate is the underlying index for most credit cards home equity loans and lines of credit auto loans and personal loans.

Average annual growth rate of current and RD expenditure per full-time equivalent student by type of institution 2012-2019. Variable rates typically start lower than fixed rates but they can also rise over time according to market conditions. In a credit-based economy a slow-down or fall in lending leads to less money in circulation with a further sharp fall in money supply as confidence reduces and.

Your rate and monthly payment are static during repayment. But if it changes thisll have an impact on your mortgage payments if you have a mortgage linked to this rate. External Benchmark Based Lending.

In the early history of the United States. According to the SBI website Benchmark Prime Lending Rate BPLR revised as 1345 pa. However most banks base their prime rates on the federal funds rate raising and lowering them in sync with changes in this rate.

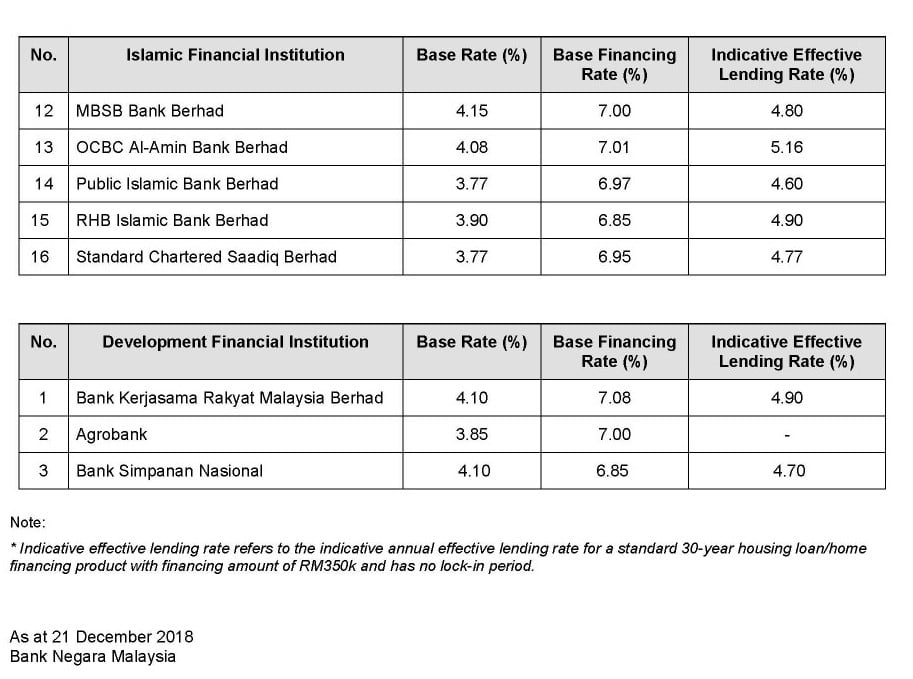

A loan contract to which 342251 applies and that is payable in a single installment may provide for an acquisition charge and an interest charge on the cash advance that does not exceed a rate or amount that would produce the same effective return determined as a true daily earnings rate as allowed under 342252 considering the amount and term of. But they cant pay less than 0 on savings or people might not deposit any money with them. Base Rates BLR and Indicative Effective Lending Rates of Financial Institutions as at 6 August 2020 Release Date.

From today HSBC said that all tracker rates would be increased to include the Bank of England base rate. Many small business loans are also indexed to the Prime rate. Prime Interest Rate as their base lending rate then add a margin profit based primarily on the amount of risk associated with a loan.

What is Standardised Base Rate SBR. The final report of the ISG was published in October 2017 for public feedback. Benchmark Prime Lending Rate BPLR revised as 1345 per cent per annum with effect from September 15 2022 the SBI posted on its website.

When the Bank of England decides to. The first part is the base rate one that reflects the overall market costs of the funding and treasury management. The cost of a merchant cash advance is usually expressed as a factor rate rather than an interest rate or APR.

Providers of consumer and commercial loan products often use the US. The bank has also raised the base rate by similar basis points to 87 per cent effective Thursday. For example its first-time buyer residential two-year tracker up to 60 per cent loan to value is 079 per cent plus the base rate.

It was revised last in June. The current BPLR rate is 1275 per cent. It is more concentrated the Journal now publishes a rate reflecting the base rate posted by at least 70 of the top ten banks by assets.

Though most personal loans are tagged with fixed rates some lenders do offer variable-rate products. As you are aware Reserve Bank had constituted an Internal Study Group ISG to examine various aspects of the marginal cost of funds-based lending rate MCLR system. The term market is sometimes used for what are more strictly exchanges organizations that facilitate the trade in.

A factor rate is a decimal figure typically between 11 and 15 which you multiply by your cash advance amount to calculate the total cost of funding. Moreover some financial institutions use Prime as an index for pricing certain time-deposit products like variable-rate Certificates of. If the base rate rises or falls lenders often pass these costs on to consumers by raising their own interest rates on loans or savings products.

Factor rates often convert to fairly high annual interest rates or APRs. Base Rates BLR and Indicative Effective Lending Rates of Financial Institutions as at 6 August 2020. In the United States the federal funds rate is the interest rate at which depository institutions banks and credit unions lend reserve balances to other depository institutions overnight on an uncollateralized basis.

Hkma Nudges Base Lending Rate 0 25pc Higher Tracking Us Fed Move South China Morning Post

George Magnus On Twitter Unrelenting Chinese Prod Price Defl W July 5 4 Base Lending Rate 4 85 Real Rate Can T Fall Fast Enough Http T Co 5ffmsorkjr Twitter

Base Lending Rates Maybank Malaysia

What Is The Latest Base Rate Or Base Lending Rate Ethan E T Teh

Base Rate Br Base Lending Rate Blr Standardised Base Rate Sbr All You Need To Know

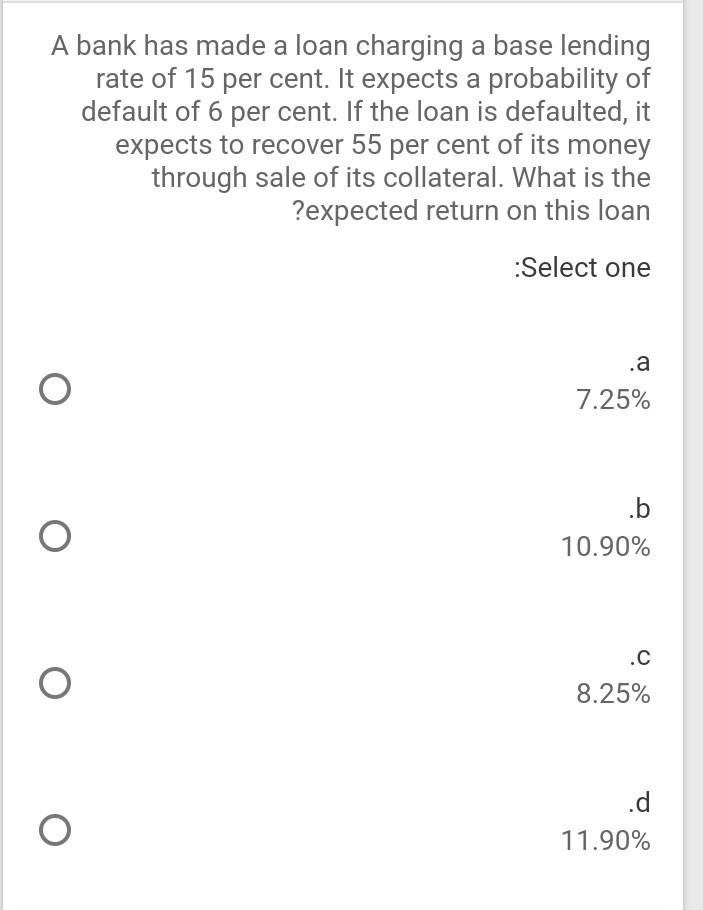

Solved A Bank Has Made A Loan Charging A Base Lending Rate Chegg Com

闲谈股市 理财篇 What Is Blr Base Lending Rate If You Want To Buy A House Or Take A Home Loan From Any Bank You Should Know The Blr Base Lending Rate And

Cbk Holds Base Lending Rate At 9 Maximum Interest Rate Remains 13 Youtube

Latest Base Rates Br Base Lending Rate Blr Interest Rates Mypf My

Latest Base Rates Br Base Lending Rate Blr Interest Rates Mypf My

Solved The Base Lending Rate That Banks Charge Their Chegg Com

Bank Negara Malaysia Blr And Indicative Effective Lending Rates Of Financial Institutions As Of 14 June 2019 Islamicmarkets Com

The Latest Base Rate Br Base Lending Rate Blr And Base Financing Rate Bfr As At 21st December 2018 Malaysia Housing Loan

What Is Repo Linked Lending Rate Rllr Loan Will It Be Beneficial

What Is The Standardised Base Rate And How Does It Affect Your Loans

Cimb Ocbc Rhb Reduces Base Lending Rates Of 2019 Comparehero

Base Rate Br Base Lending Rate Blr Standardised Base Rate Sbr All You Need To Know

Comments

Post a Comment